75 Becomes the New 65: Retiring in Your 60s Unrealistic as Life Expectancy Increases and Costs Rise

The text discusses the increasing difficulty of retiring in your 60s due to longer life expectancy, fraying social safety nets, and rising costs of living.

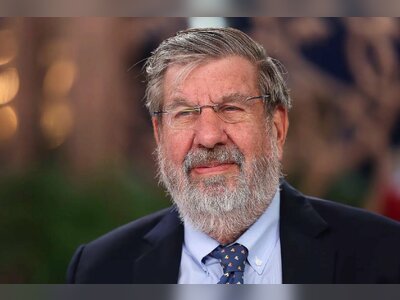

BlackRock's CEO, Larry Fink, warned in the company's annual letter that retirement at age 65 may no longer be a realistic or financially secure option for many people.

The text discusses the challenges of retirement in the current and future context.

With increasing global life expectancy, the number of older adults is projected to rise significantly, leading many countries to reach a point where more people will be leaving the workforce than entering it.

For instance, the UK may reach this milestone by 2029, and the US by 2053.

The retirement age of 65, which has remained relatively unchanged, is becoming an increasingly unrealistic goal due to the evolving health and economic landscape.

According to the UN, global life expectancy increased from 67 years in 2000 to 73 years in 2019, and is expected to continue rising.

This trend, coupled with the approaching demographic shift, raises questions about the feasibility of retirement at the traditional age.

The retirement age, which is the age at which people can collect full Social Security benefits or become eligible for Medicare in the US, has not changed in line with increasing life expectancy.

This standard, which is currently around 65-67 years old, was established as a rough judgement to encourage people to retire towards the end of their lives.

However, the reason for this age becoming a focal point is unclear.

At the time these programs were enacted in the mid-20th century, life expectancy was significantly shorter, with men in the UK living to around 66 years and women to around 71 years.

Chris Parry, a principal lecturer in finance at Cardiff Metropolitan University, points out that UK citizens used to spend only 8-10% of their lives on a pension due to shorter life expectancy.

However, with people living longer and healthier into old age, this percentage is no longer sufficient.

Government stipends, designed to support retired workers, are outdated and inadequate for the modern population in their 80s and 90s.

Many former workers lack sufficient personal savings to supplement their benefits.

Inflation is causing savings to shrink, and the traditional safety net of generational wealth is disappearing.

Wealth is now flowing from younger generations to older ones, leaving many workers struggling to save enough for retirement.

The "magic number" for retirement savings in the US is estimated to be nearly $1.3 million, a sum that most people cannot accumulate by their 60s.

This lack of savings is forcing many workers to continue working past the age of 65.

BlackRock CEO Larry Fink suggests a more aggressive investment approach starting at a younger age and working past age 65 for a comfortable retirement.

Some governments, like the UK, are raising the pension age in response to longer life expectancy.

Expert Parry believes retirement in one's 60s is no longer a reality and instead, 75 is the new retirement age.

The text discusses the challenges of retirement in the current and future context.

With increasing global life expectancy, the number of older adults is projected to rise significantly, leading many countries to reach a point where more people will be leaving the workforce than entering it.

For instance, the UK may reach this milestone by 2029, and the US by 2053.

The retirement age of 65, which has remained relatively unchanged, is becoming an increasingly unrealistic goal due to the evolving health and economic landscape.

According to the UN, global life expectancy increased from 67 years in 2000 to 73 years in 2019, and is expected to continue rising.

This trend, coupled with the approaching demographic shift, raises questions about the feasibility of retirement at the traditional age.

The retirement age, which is the age at which people can collect full Social Security benefits or become eligible for Medicare in the US, has not changed in line with increasing life expectancy.

This standard, which is currently around 65-67 years old, was established as a rough judgement to encourage people to retire towards the end of their lives.

However, the reason for this age becoming a focal point is unclear.

At the time these programs were enacted in the mid-20th century, life expectancy was significantly shorter, with men in the UK living to around 66 years and women to around 71 years.

Chris Parry, a principal lecturer in finance at Cardiff Metropolitan University, points out that UK citizens used to spend only 8-10% of their lives on a pension due to shorter life expectancy.

However, with people living longer and healthier into old age, this percentage is no longer sufficient.

Government stipends, designed to support retired workers, are outdated and inadequate for the modern population in their 80s and 90s.

Many former workers lack sufficient personal savings to supplement their benefits.

Inflation is causing savings to shrink, and the traditional safety net of generational wealth is disappearing.

Wealth is now flowing from younger generations to older ones, leaving many workers struggling to save enough for retirement.

The "magic number" for retirement savings in the US is estimated to be nearly $1.3 million, a sum that most people cannot accumulate by their 60s.

This lack of savings is forcing many workers to continue working past the age of 65.

BlackRock CEO Larry Fink suggests a more aggressive investment approach starting at a younger age and working past age 65 for a comfortable retirement.

Some governments, like the UK, are raising the pension age in response to longer life expectancy.

Expert Parry believes retirement in one's 60s is no longer a reality and instead, 75 is the new retirement age.